CID News — June-Sep. 2024

If you have information about any of these cases, email or call the Criminal Investigation Division toll free at 800-531-5441, Ext. 3-8707. You do not have to disclose your name.

Case Closed

The CID may not always get its man (or woman), but we do get quite a few. Here are some recent examples:

November 2024

Crime Does Not Pay

Madera-Manteira

Einsling Javier Madera-Manteira, 35, of Houston, was convicted of evading motor fuel tax and unlawful use of a criminal instrument.

On July 21, 2023, the defendant and his co-defendant utilized a pulsar tampering device to steal approximately 97 gallons of gasoline. The defendant delivered the illegally acquired fuel into a vehicle modified to receive, transport and deliver large quantities of unlawfully appropriated motor fuel.

A Burleson County district judge sentenced Madera-Manteira to four years’ incarceration for evading motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000, and four years’ incarceration for unlawful use of a criminal instrument, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000. The sentences will run concurrently in the Texas Department of Criminal Justice, and the defendant was given 302 days jail time credit.

Five Years for Fuel Thief

Martinez-Delrisco

Yurisman Martinez-Delrisco, 29, of Arlington, was convicted of engaging in organized criminal activity.

Between November and December 2023, the defendant and his co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting and delivering motor fuel.

A Delta County district judge sentenced Martinez-Delrisco to five years’ incarceration (with 256 days jail time credit) for engaging in organized criminal activity, a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000. The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

Do the Crime, Serve the Time

Reed

Antwan Chane Reed Jr., 29, of Memphis, Tenn., was convicted of evading motor fuel tax and transporting motor fuel without shipping documents.

On Jan. 30, 2023, the defendant manipulated a fuel dispenser pump with a factory remote control device.

A Cass County district judge sentenced Reed Jr. to three years’ incarceration (with 36 days jail time credit) and a $2,000 fine for transporting motor fuel without shipping documents and evading motor fuel tax, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000.

The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

October 2024

Motor fuel thief sentenced

Delacruz

Duniesky Vizcay Delacruz, 39, of Corpus Christi, was convicted of evading motor fuel tax and theft of a petroleum product valued at less than $10,000.

In July 2023, the defendant intentionally and knowingly evaded motor fuel tax by illegally acquiring approximately 97 gallons of diesel fuel using a pulsar tampering device. The defendant delivered the fuel into an auxiliary fuel tank in his vehicle.

A Burleson County district judge sentenced Delacruz to 4 years’ incarceration for evading motor fuel tax and 12 months incarceration for the theft of petroleum, to run concurrently, and Delacruz was given 220 days’ jail time credit.

August 2024

Jailed for Stealing

Jose Antonio Mederos Gomez, 29, of Fort Worth, was convicted of fraudulent use or possession of identifying information.

On April 12, 2023, the defendant utilized several re-encoded gift cards with financial information belonging to other people to illegally appropriate diesel fuel.

A Parker County district judge sentenced Gomez to three years’ incarceration for fraudulent use or possession of identifying information, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

15 Years for Fuel Thief

Ramon Perez-Torres, 31, of Mesquite, was convicted of engaging in organized criminal activity.

Between June and August 2022, the defendant and his co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting, and delivering motor fuel. The offenses occurred across multiple jurisdictions from Denton County to Anderson County, Texas.

A Smith County district judge sentenced Perez-Torres to 15 years’ incarceration, and he was given 486 days jail time credit for engaging in organized criminal activity, a first-degree felony punishable by five to 99 years in prison and a fine up to $10,000. The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

Do the Crime, Serve the Time

Pedro Julio Ruiz-Llanes, 33, of Burleson, was convicted of transporting motor fuel without shipping documents, evading motor fuel tax and unlawful use of a criminal instrument.

On June 5, 2023, the defendant utilized a vehicle modified to receive, transport and deliver large quantities of unlawfully appropriated motor fuel. The motor fuel was obtained by using pulsar tampering devices and stolen credit/debit card information.

A Johnson County district judge sentenced Ruiz-Llanes to four years’ incarceration, and he was given 176 days jail time credit for transporting motor fuel without shipping documents and evading motor fuel tax, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000. Unlawful use of a criminal instrument is a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

The sentence will be served in the correctional institution division of the Texas Department of Criminal Justice.

July 2024

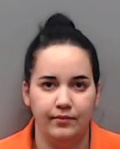

Do the time for organized crime

Camila Cruz Concepcion, 26, of Dallas, was convicted of engaging in organized criminal activity.

Between June and August 2022, the defendant and her co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting and delivering motor fuel. The offenses occurred across multiple jurisdictions from Denton County to Anderson County, Texas.

A Smith County district judge sentenced Concepcion to 10 years’ incarceration, and she was given 546 days jail time credit.

June 2024

Motor fuel thief sentenced

Edel Antonio Gonzalez Mojena, 35, of Houston, was convicted of evading motor fuel tax.

In May 2023, the defendant intentionally and knowingly evaded motor fuel tax by illegally acquiring approximately 198 gallons of diesel fuel using a re-encoded credit card. The defendant delivered the fuel into an auxiliary fuel tank in his vehicle.

A Colorado County district judge sentenced Mojena to 2 years’ incarceration, and he was given 199 days jail time credit. The defendant paid restitution of about $809.

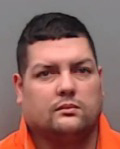

50 years for fuel theft

Duniesky Ondarza Gonzalez, 38, of Dallas, was convicted of engaging in organized criminal activity.

Between June and August 2022, the defendant and his co-defendants illegally acquired fuel by using pulsar tampering devices and stolen credit card information. The defendant utilized vehicles modified for the purpose of acquiring, transporting, and delivering motor fuel. The offenses occurred across multiple jurisdictions from Denton County to Anderson County, Texas.

A Smith County district judge sentenced Gonzalez to 50 years’ incarceration, and he was given 512 days jail time credit.

Stealing is not the answer

Wilver Benitez Rodriguez, 47, of Dallas, was convicted of evading motor fuel tax, transporting motor fuel without cargo manifest or shipping documents, and unlawful use of a criminal instrument.

In March 2020, the defendant siphoned approximately 313 gallons of diesel fuel from an underground storage tank and delivered the unlawfully appropriated fuel into an auxiliary tank mounted inside the cargo area of his vehicle.

An Ellis County district judge sentenced Rodriguez to 50 years’ incarceration.

New Cases

Breaking the state's laws is a losing proposition. Read about those who found that out the hard way.

October 2024

October 23

Danish Mohammad Khan, 51, of Richmond, was arrested for allegedly failing to keep books and records on cigarettes and tobacco products.

An investigation revealed that the suspect failed to keep books and records for four years for the cigarette and tobacco products he displayed for sale in his retail business.

Khan is charged with failing to keep books and records on cigarette and tobacco products, a third-degree felony punishable by two to 10 years in prison and a fine of up to $10,000.

The case is pending prosecution in Cameron County.

October 21

Lester Manuel Felipe Lopez, 24, of Edinburg, was arrested for allegedly engaging in motor fuel transactions without a license and evading or attempting to evade motor fuel tax.

An investigation revealed that Lopez evaded or attempted to evade a tax imposed on motor fuel by fraudulently using a credit card without the effective consent of the cardholder to unlawfully appropriate approximately 144 gallons of diesel fuel valued at $480. Lopez allegedly transported the fuel in an auxiliary fuel tank inside of a truck on public roadways without a motor fuel transporter license.

Lopez is charged with engaging in motor fuel transactions without a license, a third-degree felony punishable by two to 10 years in prison and a fine of up to $10,000, and evading or attempting to evade motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The case is pending prosecution in Hidalgo County.

October 18

Pete Martinez Jr., 44, of Midland, was arrested for allegedly failing to remit tax collected.

An investigation revealed that the suspect failed to remit tax collected on over $20,000 in motor vehicle tax.

Martinez Jr. is charged with failing to remit tax collected, a third-degree felony punishable by two to 10 years in prison and a fine of up to $10,000.

The case is pending prosecution in Midland County.

Maaz M. Moonis, 38, of Porter, pleaded guilty to failing to have an e-cigarette permit.

A Polk County district judge sentenced the defendant to one year of community supervision, 40 hours of community service, a fine of $1,250, court costs of $325, monthly payments to Polk County Clerk and Polk County Probation Department and a $50 donation to Crimestoppers.

In March 2024, an investigation revealed the defendant had not been issued nor applied for an e-cigarette retailer permit for the sales case containing numerous e-cigarette products for sale.

October 17

Alexei Hodelin Guerra, 24, of Odessa, was arrested for allegedly evading or attempting to evade motor fuel tax and unlawful use of a criminal instrument.

An investigation revealed that the suspect intentionally and knowingly evaded or attempted to evade motor fuel tax by failing to pay the backup diesel tax liability on approximately 517 gallons of illegally appropriated red-dyed diesel fuel. The fuel was delivered into an auxiliary fuel tank in the bed of a pickup truck. In Texas, non-taxable diesel is dyed red to distinguish it from taxable diesel. Red-dyed diesel is authorized almost exclusively for off-road, agricultural use by permit holders only.

Guerra is charged with evading or attempting to evade motor fuel tax, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000, and unlawful use of a criminal instrument, a third-degree felony, punishable by two to 10 years in prison and a fine of up to $10,000.

The case is pending prosecution in Ector County.

October 10

Georji Falcon Turino, 30, of Houston, was arrested for allegedly transporting motor fuel without shipping documents.

An investigation revealed the suspect was unable to provide shipping documents for approximately 600 gallons of diesel fuel that he was transporting in auxiliary fuel tanks concealed in the bed of a pickup truck.

Turino is charged with transporting motor fuel without shipping documents, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

The case is pending prosecution in Ector County.

Alberto Miguel Pupo-Remond, 33, of San Antonio, pleaded guilty to evading or attempting to evade motor fuel tax.

A Bexar County district judge sentenced the defendant to three years’ deferred adjudication, court costs and a fine.

In February 2023, an investigation revealed the defendant unlawfully appropriated approximately 46 gallons of diesel fuel valued around at $172, while only paying for seven gallons valued at $52, by using a homemade pulsar manipulation device.

Nicholas Antonio Peterson, 25, of Dallas, was indicted for allegedly transporting motor fuel without shipping documents, evading or attempting to evade motor fuel tax and unlawful use of a criminal instrument.

Peterson is charged with transporting motor fuel without shipping documents and evading or attempting to evade motor fuel tax, both second-degree felonies punishable by two to 20 years in prison and a fine up to $10,000, and unlawful use of a criminal instrument, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

An investigation revealed the defendant evaded or attempted to evade motor fuel tax by using cloned, re-encoded cards with stolen credit/debit card information to unlawfully appropriate fuel. The defendant delivered the illegally acquired fuel to an auxiliary fuel tank in the bed of a pickup.

The case is pending prosecution in Johnson County.

October 9

Diana Flores-Cibrian, 34, of Houston, was indicted for alleged bribery.

Cibrian is charged with bribery, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

An investigation revealed that the suspect was involved in a fraudulent even-trade scheme over the course of 13 months, accepting over $105,000 in cash from a company to process their title transactions containing false information. Flores-Cibrian conducted 80 fraudulent even-trade transactions with a tax avoidance of over $33,000.

The case is pending prosecution in Harris County.

Michelle Martinez, 26, of Houston, was indicted for alleged bribery.

Martinez is charged with bribery, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

An investigation revealed that the suspect was involved in a fraudulent even-trade scheme over the course of 13 months, accepting over $10,000 in cash from a company to process their title transactions containing false information. Martinez conducted 16 fraudulent even-trade transactions with a tax avoidance of over $9,000.

The case is pending prosecution in Harris County.

Cindy Gonzalez, 27, of Houston, was indicted for alleged bribery.

Gonzalez is charged with bribery, a second-degree felony punishable by two to 20 years in prison and a fine up to $10,000.

An investigation revealed that the suspect was involved in a fraudulent even-trade scheme over the course of 13 months, accepting over $67,000 in cash from a company to process their title transactions containing false information. Gonzalez conducted 97 fraudulent even-trade transactions with a tax avoidance of over $49,000.

The case is pending prosecution in Harris County.

October 7

Miguel Perez-Naranjo, 42, of Selma, pleaded guilty to evading or attempting to evade motor fuel tax and fraudulent use/possession of credit/debit cards.

A Bexar County district judge sentenced the defendant to eight years’ deferred adjudication and court costs.

In July 2023, an investigation revealed the defendant evaded or attempted to evade a tax imposed on motor fuel by using cloned, re-encoded cards with stolen credit card information to unlawfully appropriate 57 gallons of diesel fuel valued at about $200.

October 2

An investigation found the defendant sold multiple vehicles and collected sales tax from the buyers, but never transferred the title or remitted sales tax.

The case is pending prosecution in Harris County.

October 1

Krishna Kumar Ghimire, 50, of Fort Worth, pleaded guilty to possessing tobacco products with tax due.

A Palo Pinto County district judge sentenced the defendant to four years’ deferred adjudication and was ordered to pay $6,000 in restitution to the state.

In August 2023, an investigation revealed the defendant failed to produce any records for several hundred unlawful purchases of untaxed tobacco from an unknown individual, who the defendant admitted and knew to be an unlicensed distributor. Tax is required to be paid on loose pipe tobacco.

Clinton Dale Sullivan Jr., 27, of Granbury, pleaded guilty to transporting motor fuel without a license and transporting motor fuel without a cargo manifest or shipping documents.

A Hood County district judge sentenced the defendant to 10 years in the Texas Department of Criminal Justice system, but the sentence was probated for eight years on each charge.

Between June and October of 2022, an investigation revealed the defendant unlawfully acquired approximately 500 gallons of dyed diesel fuel and sold the stolen fuel for financial gain.

Donald Wayne Natt, 51, of Dallas, pleaded guilty to possession of unstamped cigarettes.

A Tarrant County district judge sentenced the defendant to three years of community supervision/deferred adjudication in lieu of confinement and received a fine and 160 hours of community service.

In January 2023, an investigation revealed the defendant unlawfully acquired unstamped cigarettes totaling 72,000 individual sticks worth over $24,000.

Jawaad Barakat, 71, of Houston, was indicted for an alleged tobacco books and records violation.

Barakat is charged with a tobacco books and records violation, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

An investigation found the defendant concealed a required book/record; knowingly made, delivered to and filed false returns or an incomplete return; and failed to keep books/records for four years as required by statute and provided a fictitious invoice.

The case is pending prosecution in Collin County.

Dmitry Yanishevsky, 48, of Murphy, was indicted for an alleged tobacco books and records violation.

Yanishevsky is charged with a tobacco books and records violation, a third-degree felony punishable by two to 10 years in prison and a fine up to $10,000.

An investigation found the defendant concealed a required book/record; knowingly made, delivered to and filed false returns or an incomplete return; and failed to keep books/records for four years as required by statute.

The case is pending prosecution in Collin County.